WGEI held a 2-days transfer pricing course in Oslo facilitated by Anders Pilskog and August Schneider from the Office of the Auditor General of Norway. The course was well attended with participants from Uganda, Sierra Leone, South Africa, Norway and the INTOSAI Development Initiative (IDI).

WGEI held a 2-days transfer pricing course in Oslo facilitated by Anders Pilskog and August Schneider from the Office of the Auditor General of Norway. The course was well attended with participants from Uganda, Sierra Leone, South Africa, Norway and the INTOSAI Development Initiative (IDI).

The aim of the course was both to emphasise the importance of transfer pricing issues within the extractive industries, and to give sessions on how to approach questions that will inevitably arise. The course first introduced the notion of transfer pricing, its significance and incentives. Moreover, the course covered different topics on transfer pricing such as the OECD guidelines on transfer pricing, transfer pricing methods, comparability and functional analyses as well as the implications of transfer pricing to the SAIs’ audit of the extractive industries. By the end of the course, the participants discussed practices and experiences in auditing transfer pricing in the extractive industries sector in their respective SAIs.

Transfer pricing in the extractive industries sector

Transfer price is a price that arises when two companies that are affiliated, in whatever way, does a transaction. This price is not subject to the same market structures as the transactions between unaffiliated companies. Since the transaction have no consequences for the company group at large, the group has incentives to shift profits to jurisdictions where the tax rate is low, and shift costs to where the tax rate is high, thus, deductions are high.

Extractive industries are, in nature, international businesses. The resource is, normally, extracted in one country and sold all over the world by a company that is located elsewhere. Furthermore, extractive industries encompasses several different sorts of trade. One thing is extraction. Others are marketing, accounting, transport, retail, legal issues, security etc. All of them within a single business group. This gives several opportunities for transfer mispricing, meaning that the price agreed upon does not reflect what the price would be under normal economic circumstances.

The course provided a brief insight into the main tools of preventing transfer mispricing. The most important concept within transfer pricing is the Arm’s Length Principle (ALP). This is an expression for determining the price that would (or could) occur for the same goods, under the same circumstances between unaffiliated parties. You may call it the market price, although that is slightly inaccurate.

Comparability and functional analyses

In finding the appropriate price in line with the ALP, we need to compare it to another price made in a comparable transaction. In order to do that we have to determine what a comparable transaction would be. For many types of transactions, e.g. price of bread, price of unskilled labour or the price of a vault, the price is common knowledge or very easy to find. When the transaction gets more complicated, the pricing also becomes complicated consequently. What is the hourly rate for an engineer with a specific knowledge not available in the country? What is the market interest rate for a loan provided by a parent company to a company that is unable to get a loan in a free market due to difficulties? There are no certain answers to these questions, but there are strategies to find an answer that is acceptable although not exact. This implies that we seldom find a perfect comparable, but we can find a transaction that has a reasonable level of comparability.

The OECD Guidelines on Transfer Pricing are the most commonly used framework to combat illegal transfer pricing. There are several others, but the difference between them is not big. According to these guidelines, a transaction is comparable if:

- none of the differences between the transactions could materially affect the price or margin, or

- reasonably accurate adjustments can be made to eliminate the material effects of any such differences.

In order to determine if one of these requirements are fulfilled, we have to do a comparability analysis.

The aim is to find a reliable benchmark for arm’s length price, or to identify a price range which unrelated parties, in a similar setting, can agree on. The comparability analysis shall identify and disregard transactions that are not comparable and coincidental or inappropriate pricing reasons.

In short, the comparability analysis is a thorough examination of the transaction at hand. It is a process that jumps back and forth in iterative steps.

The so-called functional analysis is a central component in the comparability analysis. This aims at identifying the different functions of the parties. The main idea is that the function itself determines the contribution of value, and this contribution of value indicates the profit allocated to the party. In doing this there is a need for a broad-based analysis of the taxpayers circumstances. This means that you need to take into consideration the factual circumstances and environment in which the taxpayer operates.

The most important features of a functional analysis are as follows:

- identifying the function i.e. the activities and whether it is contractual or real

- analysis through fragmentation

- establishing the contractual and actual facts of the transaction for pricing purposes

- identifying which party does what, using which assets and which risk

After doing the comparability analysis, and in particular the functional analysis we might find that the compiled price of intra-group services charged to the company might be fragmented into several separate services that are much easier to find a comparable price to. The intra-group services might consist of simple accounting services, legal services, management services etc., which is easy to price one by one. The price of accounting is easy to find, the same with simple legal services and so forth. The point of the functional analysis is therefore to identify the different (if any) micro transactions involved in the transaction as a whole.

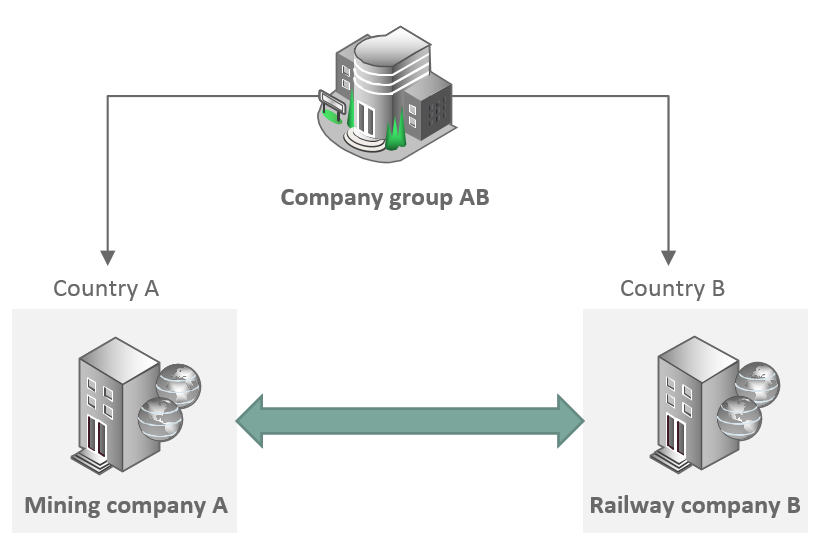

A very simple example of the process can be a situation where we have a company group (Group AB) owning a mining company A operating a mine in country A. Group AB also has a railway transporting the ore from the mine to the shore for further shipping. This railway company (company B) has a main office in country B. There is an incentive for Group AB to make company B charge Mining A an excessive price for the transport of the ore, and thus shift profit from country A.

Through a functional analysis, we are able to identify that the only function company B performs is the transport of the ore. There are no other contributions from Company B to the transaction. This implies that Company B should only be rewarded with a normal profit for transport services by railway. A typical method to use in this situation would be a Cost Plus method. The Cost Plus method requires identification of a cost base, and a normal profit on that cost base.

In order to find what a normal profit for railway transport services is, we have to identify what would be a comparable railway transportation service in this situation. The comparable does not have to be perfect as long as we can adjust for the differences. Let us say there are no other railway service within the country. We can then look to a neighbour country and look at their railway service. We adjust for differences in labour costs, maintenance cost and any other relevant cost and apply that on the transport service at within the transaction. The same with the normal profit on the cost base. Very often we can use a database and find an average range of profit (e.g. between 7 % and 10 %) and apply that on the cost base. If the price in the identified transaction is outside this range, it is within the authority of the revenue authorities to set a price within the identified range.

Importance of understanding transfer pricing for SAIs

For most SAIs the mandate to audit transfer pricing is a secondary one. In most countries, the mandate is given to the revenue authorities. However, as auditors of the revenue authorities it is crucial that the SAI has the knowledge to audit the revenue authorities’ execution of auditing transfer pricing. Therefore, it is necessary for SAIs to have in depth knowledge of transfer pricing.

During the last day, the course allowed for discussions of the participants’ practices and experiences with transfer pricing in their respective SAIs. This session enabled SAIs to share their knowledge and experience with transfer pricing and to explore potential arenas for cooperation to further build and improve SAIs’ capacity in the audit of the extractive industries sector.

If you are interested to know more about the transfer pricing course, please contact Mr. Anders Pilskog ([email protected]).